- আমাদের সম্পর্কে

-

Our Services

-

Other Offices

Divisional/Upazila Offices

Ministry/ Division/ Department

- Digital Post e-centre

-

E-Service

National E-Service

Digital Post Office (Post E-Center)

- Gallery

-

Contact

Official Contact

Contact Map

- Download

- Opinion

- আমাদের সম্পর্কে

-

Our Services

Downloads

General service

Financial services

New service

গরুত্বপূর্ণ তথ্যাবলী

-

Other Offices

Divisional/Upazila Offices

Ministry/ Division/ Department

-

Digital Post e-centre

Registration

Entrepreneur and Smart Service Point

Result

Other

-

E-Service

National E-Service

Digital Post Office (Post E-Center)

-

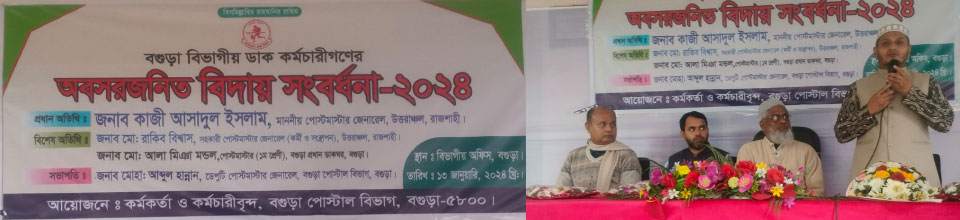

Gallery

Photo Gallery

Video Gallery

-

Contact

Official Contact

Contact Map

-

Download

From

Nicks Converter

- Opinion

Depository automation

To stop excess investment and black money, the National Savings Department has experimentally started the process of selling savings cards through automation (online). The automation has a link with the National ID card. So no one can buy savings paper in excess of the limit.

Savings Certificate

- Savings Certificate is a savings mobilization Scheme of the Government.

- At present the following savings certificates are sold & encashed from the post office.

5 -Year Bangladesh sanchayapartra.>( Limit, interest Rate)

Tin mash ontor munafa vittik sanchayapartra .>Limt, Interest rate, interest in each 3 months interval)

Pensioner sanchayapartra.>( Limit, conditions, interest rate, interest in each 3 months interval)

5-Years term Bangladesh Savings Certificate Interest

|

Period (on completaion of )

|

5-Year Bangladesh Sanchayapatra

|

||

|

Rate of Profit (%)

|

Rate of SSP (%)

|

Total Rate (%)

|

|

| At the end of 1st Year ( if the purchaser encash before maturity) |

9.35%

|

0.00%

|

9.35%

|

| At the end of 2nd Year ( if the purchaser encash before maturity) |

9.80%

|

0.00%

|

9.80%

|

| At the end of 3rd Year ( if the purchaser encash before maturity) |

10.25%

|

0.00%

|

10.25%

|

| At the end of 4th Year ( if the purchaser encash before maturity) |

10.75%

|

0.00%

|

10.75%

|

| At the end of 5th Year |

11.28%

|

0.99%

|

11.28%

|

• Tk. 30,00,000/ can be purchased in one name

• Tk. 60,00,000/- can be purchased in joint name

• Can be nominated to one or more persons.

Tin mash ontor munafa vittik sanchayapartra

| Period (on completaion of ) |

Tin Mash Antar Munafa Vittik Sanchayapatra

|

||

|

Rate of Profit (%)

|

Rate of SSP (%)

|

Total Rate (%)

|

|

| At the end of 1st Year ( if the purchaser encash before maturity) |

10.00%

|

0.00%

|

10.00%

|

| At the end of 2nd Year( if the purchaser encash before maturity) |

10.50%

|

0.00%

|

10.50%

|

| At the end of 3rd Year |

11.04%

|

0.79%

|

11.83%

|

• Tk. 30,00,000/ can be purchased in one name

• Tk. 60,00,000/- can be purchased in joint name

• Minimum have to purchase Tk. 1,00,000/-

• Can be nominated to one or more persons.

• Profit can be drawn after every 3 months.Tk. 2760.00/- is paid as profit for Tk.1,00,000/-

• 5% source tax will be deducted from profit.

Pensioner sanchayapartra

• A purchaser must be a retired person from any Govt, semi-govt autonomous body.

- A retired person should have a minimum 20 years length of service

- Any retired person who reached at the age of 55 years.

- Under family pension scheme husband/ wife/ children of the deceased employee can purchase. No age bar is applicable for them.

- A purchaser has to furnish copy of 1) pension book, 2) sanctioned memo of gratuity, 3)sanctioned memo of Provident fund at the time of purchase.

| Period (on completaion of ) |

Pensioner sanchayapartra

|

||

|

Rate of Profit (%)

|

Rate of SSP (%)

|

Total Rate (%)

|

|

| At the end of 1st Year ( if the purchaser encash before maturity) |

9.70%

|

0.00%

|

9.70%

|

| At the end of 2nd Year ( if the purchaser encash before maturity) |

10.15%

|

0.00%

|

10.15%

|

| At the end of 3rd Year ( if the purchaser encash before maturity) |

10.65%

|

0.00%

|

10.65%

|

| At the end of 4th Year ( if the purchaser encash before maturity) |

11.20%

|

0.00%

|

11.20%

|

| At the end of 5th Year |

11.76%

|

0.99%

|

12.75%

|

• Adding together pension, gratuity and provident fund a retired person can purchase upto Tk 30,00,000/- but not more than the amount drawn.

• Minimum have to purchase Tk. 50,000/-

• Can be nominated to one or more persons.

• Profit can be drawn after every 3 months.Tk.3297.50/- is paid as profit for Tk.1,00,000/-

• 5% source tax will be deducted from profit. Source tax will not be deducted from pensioner

Sanchayapatra purchased before 30/06/2011

Paribar sanchayapartra

- An adult female purchaser can purchase upto Tk. 45,00,000/-

- Minimum to purchase Tk. 10,000/-

- Can be nominated to one or more persons.

- Profit can be drawn after every 3 months.Tk.1120.83/- is paid as profit for Tk.1,00,000/-

- 5% source tax will be deducted from profit. Source tax will not be deducted from Paribar

- Sanchayapatra purchased before 30/06/2011

• Tk. 30,00,000/ can be purchased in one name

• Tk. 60,00,000/- can be purchased in joint name

• Can be nominated to one or more persons.

Tin mash ontor munafa vittik sanchayapartra

| Period (on completaion of ) |

Tin Mash Antar Munafa Vittik Sanchayapatra

|

||

|

Rate of Profit (%)

|

Rate of SSP (%)

|

Total Rate (%)

|

|

| At the end of 1st Year ( if the purchaser encash before maturity) |

10.00%

|

0.00%

|

10.00%

|

| At the end of 2nd Year( if the purchaser encash before maturity) |

10.50%

|

0.00%

|

10.50%

|

| At the end of 3rd Year |

11.04%

|

0.79%

|

11.83%

|

Tk. 30,00,000/ can be purchased in one name

• Tk. 60,00,000/- can be purchased in joint name

• Minimum have to purchase Tk. 1,00,000/-

• Can be nominated to one or more persons.

• Profit can be drawn after every 3 months.Tk. 2760.00/- is paid as profit for Tk.1,00,000/-

• 5% source tax will be deducted from profit.

Pensioner sanchayapartra

A purchaser must be a retired person from any Govt, semi-govt autonomous body.

- A retired person should have a minimum 20 years length of service

- Any retired person who reached at the age of 55 years.

- Under family pension scheme husband/ wife/ children of the deceased employee can purchase. No age bar is applicable for them.

- A purchaser has to furnish copy of 1) pension book, 2) sanctioned memo of gratuity, 3)sanctioned memo of Provident fund at the time of purchase.

| Period (on completaion of ) |

Pensioner sanchayapartra

|

||

|

Rate of Profit (%)

|

Rate of SSP (%)

|

Total Rate (%)

|

|

| At the end of 1st Year ( if the purchaser encash before maturity) |

9.70%

|

0.00%

|

9.70%

|

| At the end of 2nd Year ( if the purchaser encash before maturity) |

10.15%

|

0.00%

|

10.15%

|

| At the end of 3rd Year ( if the purchaser encash before maturity) |

10.65%

|

0.00%

|

10.65%

|

| At the end of 4th Year ( if the purchaser encash before maturity) |

11.20%

|

0.00%

|

11.20%

|

| At the end of 5th Year |

11.76%

|

0.99%

|

12.75%

|

Adding together pension, gratuity and provident fund a retired person can purchase upto Tk 30,00,000/- but not more than the amount drawn.

• Minimum have to purchase Tk. 50,000/-

• Can be nominated to one or more persons.

• Profit can be drawn after every 3 months.Tk.3297.50/- is paid as profit for Tk.1,00,000/-

• 5% source tax will be deducted from profit. Source tax will not be deducted from pensioner

Sanchayapatra purchased before 30/06/2011

Paribar sanchayapartra

- An adult female purchaser can purchase upto Tk. 45,00,000/-

- Minimum to purchase Tk. 10,000/-

- Can be nominated to one or more persons.

- Profit can be drawn after every 3 months.Tk.1120.83/- is paid as profit for Tk.1,00,000/-

- 5% source tax will be deducted from profit. Source tax will not be deducted from Paribar

Sanchayapatra purchased before 30/06/2011

| Period (on completaion of ) |

Pensioner sanchayapartra

|

||

|

Rate of Profit (%)

|

Rate of SSP (%)

|

Total Rate (%)

|

|

| At the end of 1st Year ( if the purchaser encash before maturity) |

9.50%

|

0.00%

|

9.50%

|

| At the end of 2nd Year ( if the purchaser encash before maturity) |

10.00%

|

0.00%

|

10.00%

|

| At the end of 3rd Year ( if the purchaser encash before maturity) |

11.00%

|

0.00%

|

11.00%

|

| At the end of 4th Year ( if the purchaser encash before maturity) |

11.45%

|

0.00%

|

11.45%

|

| At the end of 5th Year |

11.52%

|

1.25%

|

12.77%

|

Planning and Implementation: Cabinet Division, A2I, BCC, DoICT and BASIS